Practical Pillar 2 course

Practical course on how to prepare a Pillar 2 return from start to xml filing Our next course cycle starts Wednesday, 3 September 2025.

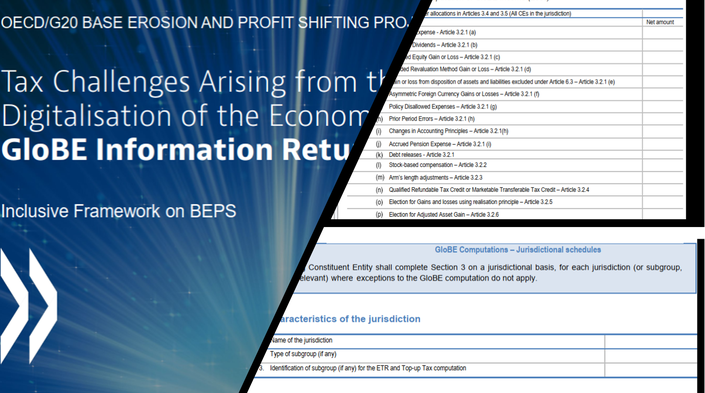

BetterTax ApS is developing a practical hands-on course, to help inhouse and other tax professionals to do their GloBE Information Report (GIR).

The course:

- Teaches a practical approach to annual data collection for the GIR.

- Provides 20+ hours of pre-recorded video lectures to building a robust Excel tool (template provided) and linking the data to the required GIR boxes.

- Explains what the most used GIR boxes means and how to do the calculations.

- Explains how to manually cross-check your return, to ensure your results make sense.

Curriculum:

Week 1: Introduce Excel tool, use 2023 CbCR for impact assessments, identify safe harbours

W 2: Calculate GloBE income outside safe harbours, GloBE options, link accounts to tool

W 3: Calculate GloBE Adjusted Covered Taxes, do per entity calculations

W 4: Calculate Total Deferred Tax Adjustment Amount and GloBE ETR, do cross-checks

W 5: Calculate Top-up taxes, UTPR, split nrs for groups, POPEs, low tax entities.

Classes start Wednesday, 3 September 2025 from 10.00 – 13.00 Central European Time and will run weekly up to and including Monday 10 March 2025. Classes will be live, online, on Teams.

IF YOU HAVE TROUBLE GETTING YOUR CT CARD ACCEPTED ON OUR SITE (which runs on a US platform), let us know at info@bettertax.info and we will send you a STRIPE ct. card payment link instead (works in all countries).

Your Instructor

My passions are tax and teaching. I love reading and understanding treaties, laws and directives; seeing how they are shaped in case law and then explaining all that in clear, simple terms with references to real life practical examples. I enjoy interacting with people, raising questions and getting them to connect the dots so that ultimately they feel comfortable with the material and their skills.

I teach transfer pricing, international corporate taxation, and Pillar 2 in a variety of formats: online automated, online face to face, and in person. My typical audiences are: governments, universities, tax professionals with continued education requirements, professional service providers and post graduate students following the Chartered Institute of Taxation’s exams for an Advanced Diploma in International Taxation (#CIOT and #ADIT).

In my teaching I bring to the table my 25+ years experience in international tax and transfer pricing from working in Amsterdam, London, New York and Copenhagen; working for large law firms, accounting firms, the Danish government and various multinationals in various industries. I also published books and numerous articles on taxation, and am currently the editor of PE Plus, an international database on the taxation of permanent establishments.

Please have look at:

Bettertax.info - our business website;

Our Youtube channel where we discuss various tax topics; and

LinkedIn - for my personal profile. Send me an invite so we can stay in touch :-).

You can reach me at: johann.muller@bettertax.info or +45-6120 2911.