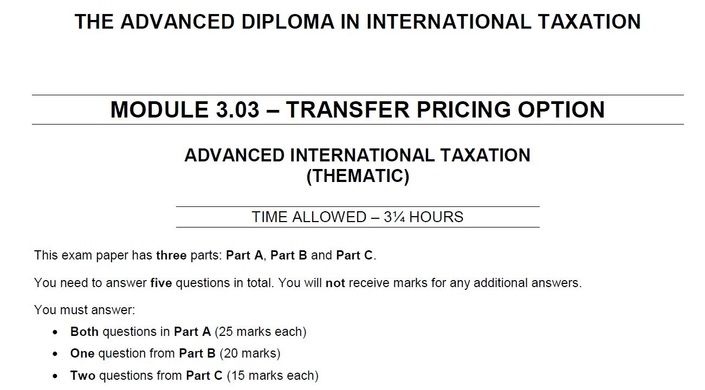

ADIT transfer pricing exam - final review and preparation - 30/11 - 7/12/2024

Interactive review of recent ADIT transfer pricing exams and exam strategies plus mock tests and exams

Watch Promo

Welcome to our 6-hour interactive review of old exams and trial tests.

Agenda

Sa 30 November, Su 1 December and Sa 7 December 2024, from 11am - 1pm Central European Time, we will:

- Look at recent exam papers, student answers and moderator answers

- Discuss strategies on time planning, which is crucial as your time is very limited

- Discuss best approaches to the different types of questions (case studies vs theory)

- Discuss other strategies to maximise your chances to pass

ALSO - Prior to that you will also have the opportunity to do several multiple choice style exam questions and get immediate feedback.

AND - We will have a mock essay question exam 29 Nov - 1 Dec on which you will get personal feedback and suggestions on writing style, etc, which again serves to help maximise your chances of passing.

Note for our students from outside the EU: if you experience any difficulties in getting your credit card payment accepted, please let us know at [email protected] and we will send you a payment link via Stripe, as soon as possible, usually within 2 hours.

Practical information

This course will be run on Teams.

Need more information? Contact us at [email protected]

Your Instructor

My passions are tax and teaching. I love reading and understanding treaties, laws and directives; seeing how they are shaped in case law and then explaining all that in clear, simple terms with references to real life practical examples. I enjoy interacting with people, raising questions and getting them to connect the dots so that ultimately they feel comfortable with the material and their skills.

I teach transfer pricing, international corporate taxation, and Pillar 2 in a variety of formats: online automated, online face to face, and in person. My typical audiences are: governments, universities, tax professionals with continued education requirements, professional service providers and post graduate students following the Chartered Institute of Taxation’s exams for an Advanced Diploma in International Taxation (#CIOT and #ADIT).

In my teaching I bring to the table my 25+ years experience in international tax and transfer pricing from working in Amsterdam, London, New York and Copenhagen; working for large law firms, accounting firms, the Danish government and various multinationals in various industries. I also published books and numerous articles on taxation, and am currently the editor of PE Plus, an international database on the taxation of permanent establishments.

Please have look at:

Bettertax.info - our business website;

Our Youtube channel where we discuss various tax topics; and

LinkedIn - for my personal profile. Send me an invite so we can stay in touch :-).

You can reach me at: [email protected] or +45-6120 2911.